It has been another tough week for Dewey & LeBoeuf as five partners and one counsel left its New York office, five partners and ten lawyers quit in Dubai and four more partners jumped ship in London.

The swingeing partner losses, combined with reports that the firm's banks could soon call in its loans, have made for increasingly lurid headlines and Dewey has had to hire crisis PR supremo Michael Sitrick (past clients include Chris Brown). This week's loss of six energy lawyers to Hunton & Williams, and nine partners and eight associates to Dechert's London and Dubai offices takes total partner losses for 2012 to 66. That's a massive 22% of the partnership, enough to trigger rumours that Dewey may now be approaching default under its loan agreements, which require the firm to maintain a certain proportion of its partnership (thought to be around 75%).

And the crisis seems to be worsening as reports emerge that the firm's Moscow office is considering moving wholesale to another US firm. Although, according to Dewey, there have as yet been no resignations. The firm's Polish and French arms are also reported to be on the hunt for another firm and Dewey's Italian offices are negotiating an exit from the US LLP, according to a Lawyer report. Plus, the firm's Middle East business is being restructured following a number of departures, which may result in the closure of the Dubai, Abu Dhabi and Doha offices. At this rate, by Christmas it will be just the tea lady in Boston and the post boys in Washington left.

Dewey is manfully spinning the line that it's downsizing to cement profitability. A spokesman for the firm said the reduced headcount was all part of an "approved" new direction and the number who have left "is consistent with the reduced headcount contemplated by our plan". And as for the Middle East, Dewey stresses that departures "will not have a material impact on the firm's bottom-line or its business". And it's keen to point out that it's still winning business in the region, too, proudly announcing a new instruction from the Saudi electricity authority.

But with so many waves of departures and more predicted, it's all looking a bit shaky. The firm has suffered from its policy of poaching star partners on multi-million dollar pay packets, which the firm was then forced to cut when it missed financial targets. And a mass of outstanding client bills have damaged the Dewey's cashflow. The next few weeks will be a critical test of the nerve of its lenders and the loyalty of its remaining partners.

Tip Off ROF

The swingeing partner losses, combined with reports that the firm's banks could soon call in its loans, have made for increasingly lurid headlines and Dewey has had to hire crisis PR supremo Michael Sitrick (past clients include Chris Brown). This week's loss of six energy lawyers to Hunton & Williams, and nine partners and eight associates to Dechert's London and Dubai offices takes total partner losses for 2012 to 66. That's a massive 22% of the partnership, enough to trigger rumours that Dewey may now be approaching default under its loan agreements, which require the firm to maintain a certain proportion of its partnership (thought to be around 75%).

|

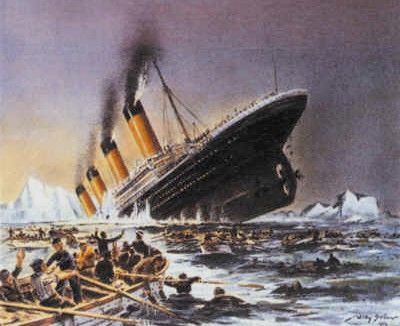

Dewey partners rowing off into the sunset yesterday |

And the crisis seems to be worsening as reports emerge that the firm's Moscow office is considering moving wholesale to another US firm. Although, according to Dewey, there have as yet been no resignations. The firm's Polish and French arms are also reported to be on the hunt for another firm and Dewey's Italian offices are negotiating an exit from the US LLP, according to a Lawyer report. Plus, the firm's Middle East business is being restructured following a number of departures, which may result in the closure of the Dubai, Abu Dhabi and Doha offices. At this rate, by Christmas it will be just the tea lady in Boston and the post boys in Washington left.

Dewey is manfully spinning the line that it's downsizing to cement profitability. A spokesman for the firm said the reduced headcount was all part of an "approved" new direction and the number who have left "is consistent with the reduced headcount contemplated by our plan". And as for the Middle East, Dewey stresses that departures "will not have a material impact on the firm's bottom-line or its business". And it's keen to point out that it's still winning business in the region, too, proudly announcing a new instruction from the Saudi electricity authority.

But with so many waves of departures and more predicted, it's all looking a bit shaky. The firm has suffered from its policy of poaching star partners on multi-million dollar pay packets, which the firm was then forced to cut when it missed financial targets. And a mass of outstanding client bills have damaged the Dewey's cashflow. The next few weeks will be a critical test of the nerve of its lenders and the loyalty of its remaining partners.