Just add cash!

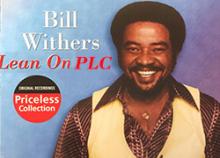

Withers has made a cash call to all its junior partners, RollOnFriday has learned.

The firm confirmed that junior equity partners have been asked to contribute between $25,000 and $52,500 (£19.9k - £41.7k) each, depending on their seniority.

Cash calls can help partnerships shore up their balance sheets, which has become a more pressing matter for some firms as they face off against market pressures exacerbated by the impact of the pandemic, Russia’s invasion of Ukraine and, for those based in the UK, Brexit.

Withers expanded significantly in the States last year, where it took a bullish position on the future of office working versus WFH by moving into much larger premises in LA, San Francisco and San Diego.

However, the firm told RollOnFriday that its decision to seek a capital contribution was taken two years ago. Rather than an emergency funding drive, it appears it was a desire to help junior partners embrace the financial bond between lawyer and firm that motivated the call.

In a statement it said, "We have asked junior equity partners to provide a capital contribution for the first time of between $25,000-$52,500, depending on seniority, so they are more fully involved in the ownership of the business". The call has not gone out to senior equity partners, whose capital requirement remans unchanged, said the firm.

One of the City's oldest blue blood private client practices, the past decade saw Withers become Withersworldwide and take everyone by surprise with a US merger and an international roll-out to some pretty flashy locations (Milan, Tokyo, New York, just down from Domino's in Cambridge).

It certainly hasn't given the impression of a firm struggling to make money. Withers posted £267m in global revenue for 2022, up from £243.7m the year before, while profit per equity partner held steady at £668,000 following a 32% rise in 2021.

The firm was feeling sufficiently flush last summer that it even dished out a special £1,000 cost of living payment to all trainees, secretaries, paralegals in EU and Asia, and business services employees below manager level.

Speaking to the surging revenue generated by the US offices, Michael Brophy, Withers' Los Angeles managing director, said in 2022, “Every year we erode globally into the idea that the London market is the most important market to the firm”. He'll take their cash, though.

![]() Let top firms and companies ping your app when they like you for a role. Whether or not you're actively looking to move, keep one ear open by downloading LawyerUp on the App Store or Google Play.

Let top firms and companies ping your app when they like you for a role. Whether or not you're actively looking to move, keep one ear open by downloading LawyerUp on the App Store or Google Play.

Comments

39

41

This is a total non story, ROF. Quiet week, I guess?

40

37

'We have asked junior equity partners to provide a capital contribution for the first time of between $25,000-$52,500, depending on seniority, so they are more fully involved in the ownership of the business'

Isn't that nice of them.

42

36

So... the firm that makes a mint from dodgy bastards with offshore trusts needs to ask the partners for cash because they can no longer act for the really dodgy ones?

Maybe a business model overhaul, Withers, and maybe don't facilitate tax avoidancevasion.

39

40

@Yawn - a well known firm issues a massive cash call on junior partners and that’s not a story? What are you, Withers’ PR?

55

32

Lol @ #WithersPR bot fighting back

it’s legit biz goss, suck it up

39

40

Anything to do with the UK tax rules re. salaried partners I wonder?

38

36

Ooh good point though the rules have been around for a while so…

38

37

Looking after the senior equity partners at the expense of junior partners is commonplace; especially when things get gritty and the senior partners think that the trough is running low.

I was a “fixed share member” at firm who had merged with a nonentity US shop a few years ago and I can genuinely say that I had less involvement in the ownership of the business than the assistant in Joe the Juice on Cannon Street. As a class of “partner” we were just above amoeba status yet we were expected to contribute to the financial health of the firm yet have no say.

42

32

What do the references above to UK tax rules for salaried partners refer to, please?

44

35

Hard to see this as an act of confidence in the firm or its forecasted performance in the current financial climate. The timing implies that they are expecting rough times ahead, a key practice area is declining or they are having to quickly invest in an area/market that they hadn't planned for. Could also be to stop the move of talent? Once you have paid in, it is much harder to 'exit' you. Basing this on no evidence, just here for the drama...

35

34

Question - Quite a few years back (2014 from memory) there was change to UK tax law that meant a member of an LLP would be taxed as an employee unless certain tests were met (degree of control exercised by the member, size of capital contribution etc). It was to prevent a tax dodge whereby an employee was called a partner and the firm didn't have to pay employer NICs. A lot of firms solved for this by making junior partners make a capital contribution (and maybe Withers have decided they are not passing muster on the control test so are going down this path).

44

27

Anon 05 May 23 12:54

If it’s the same firm as I was in (now run from the mid-west US) then you are absolutely correct plus they could kick you out the door on a whim without reason; if fact, that class of partner (sic) has fewer rights than a nine year old Victorian chimney sweep yet was still on the hook for significant capital contributions (and liabilities).

Facing facts; the majority of law firms are run by and for the full benefit of those partners at the top of the equity. Aspiring partners should think long and hard about partnership before taking the plunge.

34

23

Can I offer my daughter a training contract? asking for a friend.

33

26

I suspect this is about saving employers NI and most junior partners will be able to access specifically designed finance for partners facilitated by the firm m