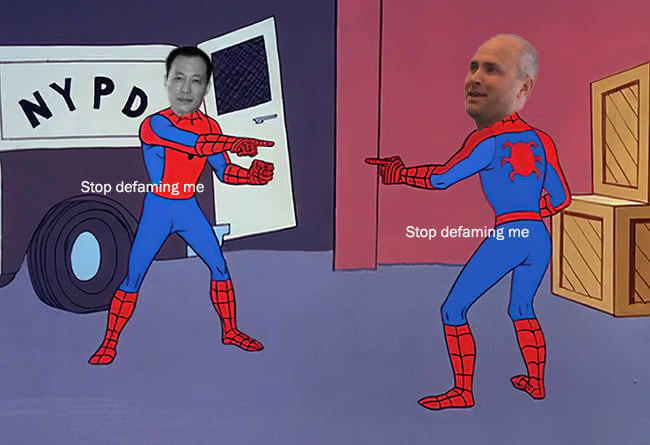

Sad to see Zhang and McNamara fall out over a little thing like $35m.

Dentons has rejected the claim by a former partner who is suing the firm that its CEO in the US stepped down as a result of his case.

Mike McNamara left his management role as part of a revamp of Dentons' leadership at the start of July. But a former partner in the firm's Los Angeles office, John Zhang, claims McNamara actually left because Zhang went public with the CEO's "illegal and unethical conduct".

Zhang told RollOnFriday, "I had asked for his head on April 30, 2021, named him a defendant on May 24, 2021 and sent a letter to Dentons' partners on June 16 to challenge him. He stepped down on July 1. This is of course total vindication of my case".

However, Dentons has rejected any suggestion of a link.

“There is absolutely no connection between a change in US leadership and Zhang’s allegations, and to suggest so is false", it told RollOnFriday in a statement.

"Mike McNamara is one of the most respected partners in the firm and talented business leaders in the industry who led Dentons for more than a decade. Mike will continue to bring strong business acumen and trusted judgement to our firm and clients with integrity", it said.

Dentons also rebutted the version of events put forward by Paul Murphy, Zhang's lawyer, who said that McNamara had been "removed", with "no succession plan" and "without any advance notice", and suggested it was "because of the exact allegations that we've been talking about".

Dentons said, "Law firms regularly rotate leadership responsibilities amongst senior Partners, particularly after a long time period of service, and in this case, after Mike led our US team successfully through the global pandemic, yielding record firm profits in the US in 2020 and in the first half of 2021".

The spat began when Zhang netted a $35 million contingency fee from a client in China. In his lawsuit, Zhang alleges that McNamara and Edward Reich, the General Counsel of Dentons in the US, conspired with other Dentons lawyers to transfer the fee directly to Dentons, which involved forging a document with the client's letterhead and signature.

Zhang claims that when he reported his discovery to the governing board in the US and demanded McNamara's "immediate termination", he was fired.

The firm has maintained that Zhang's accusations are "as outrageous as they are untrue", and an "utter fabrication", and that Zhang was actually fired because he tried to divert 85% of the contingency fee to himself in breach of his partnership obligations.

Patrick Collins, a King & Spalding partner and counsel to Dentons in the Zhang matter, said, "While anyone can hurl reckless allegations, I can say unequivocally that there was never any forgery of any documents in this matter by anyone at Dentons. The allegation is false and defamatory and will be proven so in the appropriate arbitral forum".

As part of their all-out war, Zhang sent an open letter to Dentons partners in June accusing the firm of smearing him and calling on his former colleagues to reserve judgement.

He claimed that he told McNamara about his proposal to take a direct cut of the contingency fee and that, "At the time, Mike did not accuse me of fraud or anything like that". He also invited a further escalation of hostilities, informing the partners that "I challenge Mike to countersue me for defamation if my allegations in the complaint are untrue".

Comments

47

32

Tsk. Get a room guys.

71

43

Dentons covering themselves in glory...

Sorry for the staff having to watch senior management fighting like divorced parents.

54

42

This happened in my firm too. A partner caught management members doctoring completed appraisal records, which were then used to justify reducing pay of our of favour individuals. They silenced him with a huge payout and an NDA, but the three most culpable management members then all “retired” soon after.

57

32

I think I know which firm you refer to MCtoo, bits of the story was in Rof. It’s astonishing that the regulator never took action against that firm. The level of dishonesty and bad motives evident to stab your colleagues in the back by faking appraisal records is sky high. Seems the regulator is more interested as always in the easier target of the panicked and overworked juniors who make mistakes and try and cover up, than very senior partners in powerful law firms invoked in a shocking conspiracy.