Not quite as serious as the PSNI breach, admittedly.

A list of all the former employees of Plexus owed money by the failed firm - along with the sums they are each owed - was accidentally published on Companies House.

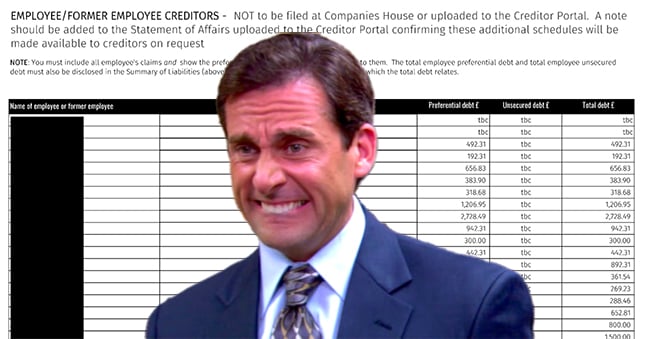

The schedule was headed “EMPLOYEE/FORMER EMPLOYEE CREDITORS – NOT to be filed at Companies House or uploaded to the Creditor Portal”.

RollOnFriday stumbled across the document while poring through Interpath's administrator report.

It sets out the names of 107 Plexus staff, including partners, solicitors and paralegals, who were left out of pocket when Plexus collapsed.

The data reveals that Plexus owed dozens of its people sums ranging from as little as £192 (to a paralegal now at a rival firm), to over £5k (to an associate now working in-house).

When ROF alerted Interpath, Managing Director James Clark said that Companies House had uploaded the schedule in error. The report was quickly removed from the site and would be redacted, he said.

But Companies House denied it was to blame and told ROF the balls-up was the administrator's fault.

A Companies House spokesperson said, “We take data protection seriously. The Insolvency Rules for England and Wales make it clear that administrators must remove details of employee creditors before filing a statement of affairs with Companies House".

"We have removed the material that was submitted in error and are reviewing the case to ensure our examination processes are robust and we are compliant with data protection legislation", they said.

A datashambles is a fitting end for Plexus, which on its way down the tubes had to restate its accounts at Companies House following the discovery that they were riddled with multi-million pound errors.

The firm collapsed when HMRC ran out of patience with Plexus's delays and demanded the immediate payment of £4.3m which it believed it was owed in outstanding taxes.

HMRC's ultimatum prompted Plexus majority owner Access Capital Partners, which backed the business alongside Origin Equity, to withdraw a promise of emergency funding, effectively dooming the firm.

After searching for a buyer, Plexus was placed into administration and its assets were sold to Axiom Ince Ltd for just £1.1m. The administrator said creditors, owed upwards of £20m, were ‘highly unlikely’ to recover their cash.

Axiom’s recent purchase of Ince was a similar story, but the transfer of Plexus's assets to the firm at least preserved hundreds of jobs. However, around 100 of its 632 staff refused to be TUPE’d across and quit the firm instead.

Plexus staff weren’t the only creditors stiffed by their former employer. HMRC is unlikely to see repayment of its recalculated debt of £3.3m, while another Plexus backer, AIB group, is in line to recover just £185,000 of its estimated £4.6m debt.

One of the most significant creditors was Macfarlanes. Owed £477k, the City firm was the third largest trade creditor behind only Microsoft (£1.04m) and a landlord (£536k).

Among other trade creditors, £38.99 was owed to a party decorations company, suggesting that someone still knew how to have fun while the firm turned to ash, and £221 was incurred on Lofbergs coffee, which was presumably necessary once all the water cooler suppliers - owed over £10k by the end - stopped delivering.

When Plexus went under it also owed money to 27 fixed share partners, beginning at £34k. The largest amount, £100k, was due to Olivia Roberts, although comments reaching ROF suggest that not all staff will shed a tear for their former CEO.

![]() LawyerUp lets you know directly from top firms when they like you for a role. Grab it on the App Store and Google Play.

LawyerUp lets you know directly from top firms when they like you for a role. Grab it on the App Store and Google Play.

Comments

65

21

I hope they bring data breach claims against the Administrators.

48

16

James is just following the MO of Origin now he is the office holder. F*** Up. Blame someone else. Repeat.

69

14

Macfarlanes acted for Origin Equity/Plexus PE management, owed £477k and now acting for Interpath in the administration….. call me old fashioned but if that’s not a conflict then I don’t know what is!!

36

15

This sort of casual foul up and even more casual attempt at blameshifting is just not good enough.

45

14

Sorry, Companies House was at fault here? What a pathetic way of trying to pass the buck...

32

13

James is shameless trying to pass the buck with the “it wasn’t me gov, honest!” defence

41

11

IT'S EVERYONE'S FAULT BUT MINE

28

12

Hopefully James will prove to be more competent when investigating Gav and Olivia and their dubious assurances made verbally and in writing.

23

16

They can't both be blameless...

23

9

Who's James? lol

26

14

It’s James Clark who was the insolvency practitioner and now the administrator.